Canada has picked copper as a cornerstone of its next economic chapter. Ottawa’s initial list of projects to receive expedited federal reviews features two large copper developments, signaling a deliberate push to turn the red metal into an engine for growth, supply chain security, and cleaner industry.

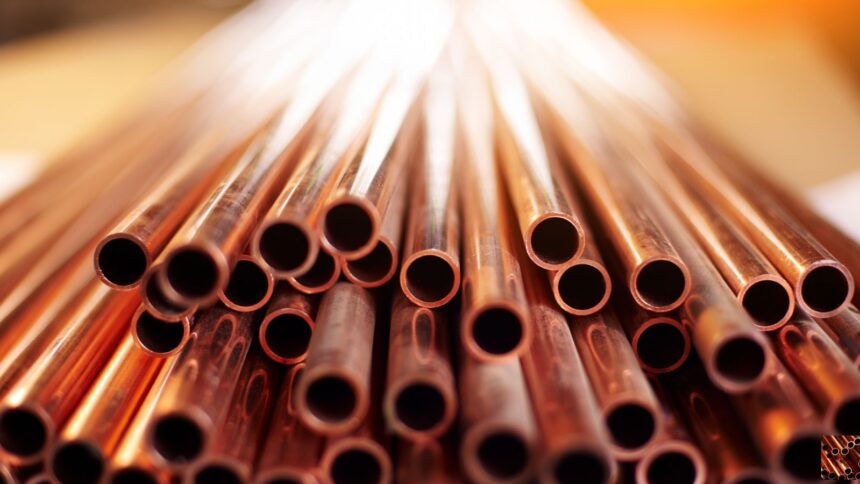

Copper is the wiring behind electrification, from utility-scale transmission to vehicle motors, charging networks, heat pumps, and data centers.

Ottawa’s view is that bottlenecks in copper supply risk delaying everything from grid upgrades to factory retooling. Prioritizing copper projects is meant to remove a key constraint while drawing capital back to Canadian mining and processing.

In British Columbia, the proposed expansion of the Red Chris copper-gold mine would extend the operation’s life and, according to federal planning materials, lift Canada’s annual copper output while sharply cutting emissions once the upgrade is running.

In Saskatchewan, Foran Mining’s McIlvenna Bay project is positioned as a net-zero design that would add domestic copper and zinc supply and create several hundred jobs as it ramps toward commercial production.

Both files are now flagged for review by the new Major Projects Office, which is tasked with coordinating federal approvals and financing tools for developments deemed in the national interest.

The government’s new process under the Building Canada Act is meant to give proponents earlier certainty on federal conditions while maintaining Indigenous consultation and environmental protections.

The goal is not simply to wave projects through. It is to avoid years of duplicative reviews and last-minute surprises that can strand capital and sour local support.

The Canadian Critical Minerals Strategy identifies copper among its priority materials for clean growth, and federal programs have begun to steer dollars toward enabling infrastructure and lower-carbon mine designs.

Ottawa has earmarked dedicated funds for transmission and transport links that can unlock deposits in remote regions, and separate innovation financing has started to back technologies such as battery-electric fleets, ventilation on demand, and advanced water systems at mine sites. The intent is to make Canadian copper not only available, but also cleaner per tonne produced.

Copper is cyclical, and price swings can collide with multiyear build schedules. Financing models that rely on high spot prices will look fragile if the global cycle turns.

Environmental and safety performance will remain under a microscope, particularly in regions with recent incidents and in projects proposing new mining methods underground. Indigenous partnership is not a box to check.

Equity stakes, revenue sharing, and community-led monitoring are increasingly prerequisites for social license, and the new federal system will be judged on how well it embeds those arrangements early.