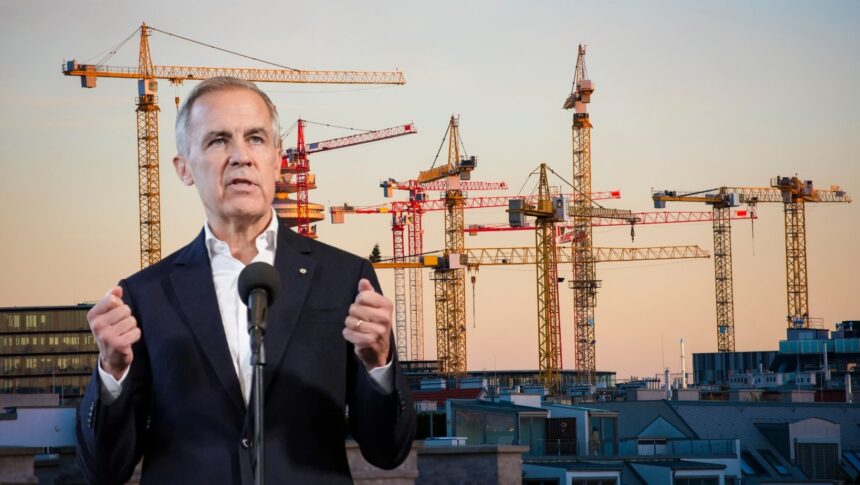

The first list of national projects flagged for expedited review under Prime Minister Mark Carney’s new Major Projects Office is smaller and more familiar than the campaign rhetoric suggested.

Rather than unveiling sweeping nation-building corridors, the government named five industrial builds that are already well advanced: a planned second phase at the LNG Canada export terminal in Kitimat, Ontario Power Generation’s small modular reactor at Darlington.

An expansion of the Port of Montreal at Contrecœur, Foran Mining’s McIlvenna Bay copper project in Saskatchewan, and an expansion of Newmont’s Red Chris copper-gold mine in northwest British Columbia.

The selection reads as a bet on pace and deliverability over spectacle.

Ottawa wants to show that it can cut through the procedural thicket that has slowed large projects for years. The Major Projects Office is pitched as a single window to broker approvals, financing structures and multi-party agreements.

In its announcement, the government framed the first tranche as “projects of national significance” that will move into a more hands-on federal process with provinces, Indigenous rights holders and private sponsors to find a viable path to construction.

It also signaled that a broader pipeline of candidates exists and that more additions are coming in the months ahead. That sequencing matters because it hints at a rolling, adaptive shortlist rather than one grand reveal.

If the slate feels underwhelming to some, that is partly the point. Each pick comes with a proven sponsor, a clear industrial rationale and relatively bounded regulatory risk.

There is no new oil pipeline, no transcontinental high-voltage line, no greenfield steel plant. Instead, the list clusters around three themes: expanding export capacity already in motion, adding firm clean power, and unlocking critical minerals.

LNG Canada Phase 2 would double down on an asset that has already shipped first cargoes, positioning Canadian molecules for Asia while reinforcing the Pacific gateway strategy.

The Darlington SMR would add zero-emissions baseload and serve as a template for modular nuclear replication if costs and schedules hold.

The Contrecœur terminal would lift container throughput at a strategic port that anchors Quebec’s trade with Europe and the U.S. Midwest.

Copper, via McIlvenna Bay and Red Chris, underpins electrification supply chains the government says it wants to cultivate at home.

There are signals embedded in what was left out, and choosing expansions and later-stage builds suggests Ottawa is prioritizing near-term construction starts, taxable activity, and demonstrable wins over riskier moonshots.

With trade tensions simmering and a premium on resilience, the quickest path to more exports and industrial capacity is often to widen the spigot on assets already through most of the permitting gauntlet.

It also lowers fiscal exposure: these are largely private-led projects where the federal role is coordination, not writing nine-figure checks.

LNG Canada’s second phase has not yet reached a final investment decision by its partners, and the timing will hinge on global LNG pricing and portfolio choices at the operator level.

Similarly, the Montreal terminal remains subject to environmental conditions and community acceptance, and critical minerals projects worldwide face cost inflation and supply-chain tightness.

The government’s own material underscores that the new office is meant to help navigate precisely these hurdles, but faster does not mean easy.

In-depth look at Carney Hits Pause on EV Mandate as Canada Balances Trade, Jobs, and Tariffs

The politics are as notable as the engineering; the five-pack spreads benefits across regions without picking the pipeline fights that have long divided Ottawa and Alberta.

It gives Ontario a flagship nuclear build that aligns with the province’s electrification plans.

It sustains British Columbia’s role as Canada’s Pacific gateway while nodding to the copper story that both B.C. and Saskatchewan want to tell investors.

For a government eager to reset Canada’s reputation for actually building things, this is a pragmatic first cut aimed at momentum rather than a constitution-sized debate about where to draw new national corridors.

Ottawa is prepared to spend political capital on LNG, nuclear, critical minerals, and trade infrastructure, with an emphasis on projects that can credibly break ground.

Whether the next wave tilts bolder will depend on how this cohort performs. If timelines compress and early wins materialize, expect more ambitious bets on grid interties, carbon management and perhaps new industrial platforms.

If the process bogs down, the appetite for bigger swings will shrink.

For now, the message is that Canada will start by finishing. The government is putting its shoulder behind projects that can move, as proof of concept for a faster federal playbook. The grand vision can wait, but cranes and contracts cannot.