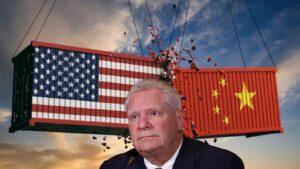

Canada’s trade standoff with Washington has moved from slow burn to front burner, and the pressure is now on Prime Minister Mark Carney to deliver a credible off ramp.

After high level talks in the U.S. this week, Ottawa is signaling that officials are working sector by sector to blunt damage from tariffs while keeping the broader relationship intact.

The United States remains Canada’s largest market and a tightly woven supply chain means policy shifts ripple quickly through factories, farms, and ports.

Diplomacy aimed at narrowing the scope of U.S. measures and securing carve outs where supply chains are most integrated, notably autos and metalmaking.

The other is domestic cushioning to keep investment onshore and workers on payrolls while negotiations grind on that includes regulatory pacing and project delivery meant to shore up growth at home, from the Major Projects Office to broader industrial policy that shapes where capital flows next.

Carney’s allies argue that a credible domestic growth plan strengthens his hand in trade talks by showing Canada can absorb shocks without retreating from competitiveness.

Manufacturers want predictability and relief on intermediate inputs that cross the border multiple times before final assembly.

Energy producers and miners are watching for any move that changes cost curves on equipment and processing. Retailers are bracing for pass through effects that could weigh on consumer demand heading into the holidays.

Small firms, already squeezed by higher borrowing costs, want targeted support that arrives faster and with fewer strings.

Ottawa has begun to sketch out relief in select regions and sectors, including programs highlighted in British Columbia, but industry groups say the timelines must shorten and the criteria must be transparent.

Premiers are pushing for clarity on how exemptions will be prioritized and which projects will be accelerated to offset trade friction.

The prime minister has shown a willingness to adjust pacing on climate and industrial rules when trade realities bite, as seen when he hit pause on the EV mandate to align policy with jobs and investment.

This pragmatism may help secure temporary accommodations with U.S. counterparts, but it also raises expectations at home that Ottawa can shield exposed industries without sacrificing longer term goals.

A durable path to tariff relief would likely steady the Canadian dollar by easing growth risks and reducing the odds of deeper policy stimulus.

Auto suppliers, railways, and steel producers are most sensitive to clarity on carve outs and customs procedures, while retailers and consumer goods names feel the downstream effects.

If Ottawa accelerates permitting and major builds alongside targeted aid, it could pull forward private investment and temper the drag from trade.

This would reinforce the case for a mid cycle resilience narrative that does not depend on broad fiscal expansion.