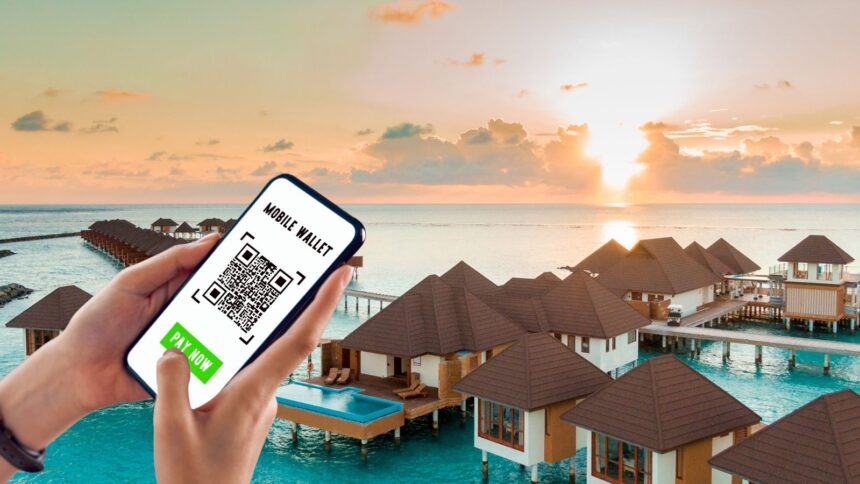

PayPal is teaming up with Ooredoo Fintech to expand digital payment options in the Maldives, a small but globally connected market where tourism and cross-border commerce drive demand for seamless transactions.

The partners said they aim to introduce PayPal services for local consumers and merchants, with a roll out targeted for 2026. The timeline and scope will depend on integration work and regulatory clearances in the island nation.

The collaboration would give Maldivian buyers more ways to pay online and allow small businesses to accept funds from abroad with fewer frictions.

Access to PayPal’s network could help local tour operators, guesthouses, freelancers, and import reliant retailers capture sales from international customers who prefer transacting through established global platforms.

PayPal support could cut checkout friction and reduce cart abandonment by offering a familiar wallet and buyer protections.

The Maldives adds another stepping stone in a broader push to deepen coverage across high spending travel corridors and remittance routes.

While the country’s population is modest, its visitor inflows create outsized e-commerce demand relative to its size.

A tie-up with a local telecom-backed fintech also offers distribution advantages, including access to an existing user base and on the ground compliance expertise.

Ooredoo Fintech brings local rails, brand recognition, and mobile distribution, which can reduce the lift of onboarding merchants and managing identity checks.

Pairing those assets with PayPal’s global acceptance and fraud tooling could accelerate merchant adoption, especially among micro and small enterprises that currently juggle bank transfers, cash, and a patchwork of payment gateways.

The initiative lands as investor interest in payments and fintech infrastructure remains resilient through market cycles.

Public listings and partnerships have signaled that capital is still flowing into scaled platforms and gateway providers. One reference point came with the Klarna Wall Street debut, which highlighted the market’s appetite for payment firms with large user bases and strong unit economics.

Incumbents are exploring connectivity to tokenized markets, illustrated by how Franklin Templeton joins forces with crypto exchanges to broaden distribution. Although these are different corners of finance, the underlying theme is the same, users expect faster, simpler, and more interoperable ways to move money.

The partners did not disclose fee structures or which specific PayPal services will be available at launch. Details such as currency support, withdrawal options to local banks, and dispute resolution processes will be critical for adoption.