Fresnillo plc has agreed to buy Probe Gold Inc. for C$780 million in cash.

This is the first time the London-listed miner has entered Canada, and it will add a large undeveloped gold resource in Québec to its pipeline.

Under a definitive arrangement agreement, Probe shareholders will get C$3.65 for each share they own. This makes the deal worth about US$560 million.

Probe said the price is 39% higher than its closing price on October 30 and 26% higher than its 20 day average. In its regulatory notice, Fresnillo said the premium was 24% higher than the 30 day average.

Under Ontario corporate law, the deal will go through a plan of arrangement. It is expected to be finished in the first quarter of 2026, but it still needs to be approved by shareholders, the court, and other normal steps.

Fresnillo said it will pay for the purchase with cash it already has and does not plan to change its dividend policy.

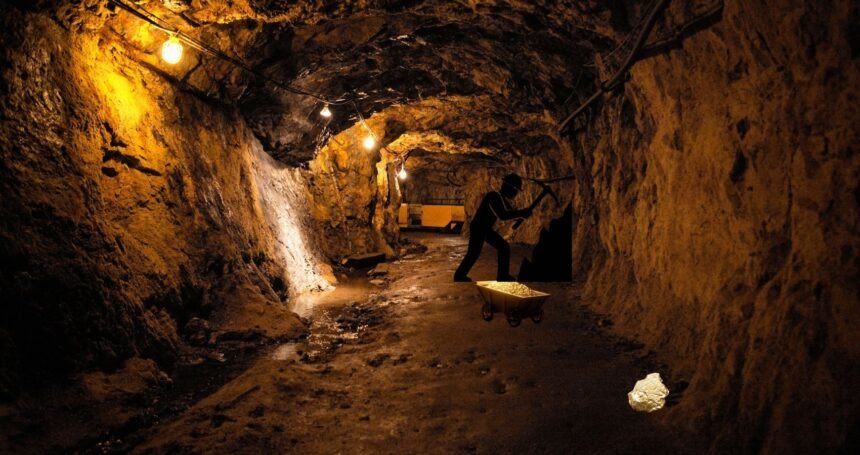

Fresnillo now owns Probe’s Novador project in the Val-d’Or mining camp and an early stage Detour Gold Québec project.

Probe says it has a land position of about 1,798 square kilometres in Québec, with most of its resources located in Novador.

Fresnillo told investors that the combined portfolio has about $10 million ounces of gold resources, with about $8 million ounces at Novador.

The company thinks that this could support more than 200,000 ounces of annual output over a mine life of more than ten years.

In an RNS filing, Fresnillo CEO Octavio Alvidrez said, “We are excited to be coming to Canada.” David Palmer, the CEO of Probe, said in a press release, “This deal offers a good premium and is a great outcome for our shareholders.”

Under Canada’s MI 61-101 rules, the deal needs to be approved by at least two-thirds of the votes cast and a simple majority of minority shareholders at a special meeting that is expected to happen in January.

Directors and officers of Probe and Eldorado Gold, who own about 12% of the shares, have signed agreements to vote in favour of the deal.

The arrangement agreement has standard protections, like a C$31 million break fee that Probe has to pay in some situations.

When the deal is done, Probe’s shares will no longer be listed on the TSX, and it will no longer be a reporting issuer in Canada.

The purchase is part of Fresnillo’s growth strategy, which includes making opportunistic acquisitions and developing its Mexican assets while keeping precious metals at the centre of everything.

Management said that the deal will be paid for entirely with money from the company’s balance sheet, which had about US$1.8 billion in cash as of June 30.

Sprott started an active metals and miners fund in September because the price of gold was going up and more money was coming into the sector.

Consolidation is still a big deal in Canadian resources, as shown by the merger of Teck and Anglo. Fresnillo’s move shows that high quality Québec ounces are still attracting buyers from around the world who want stable places to invest and assets that can grow.

A Tier-1 location with good infrastructure and a skilled workforce, a flagship project that is big and has clear paths for growth, and a land package with the option to explore.

If Fresnillo moves Novador closer to production at its stated potential, the asset could become a significant gold contributor alongside the company’s Mexican operations. This would spread out the company’s country risk while keeping the focus on precious metals.