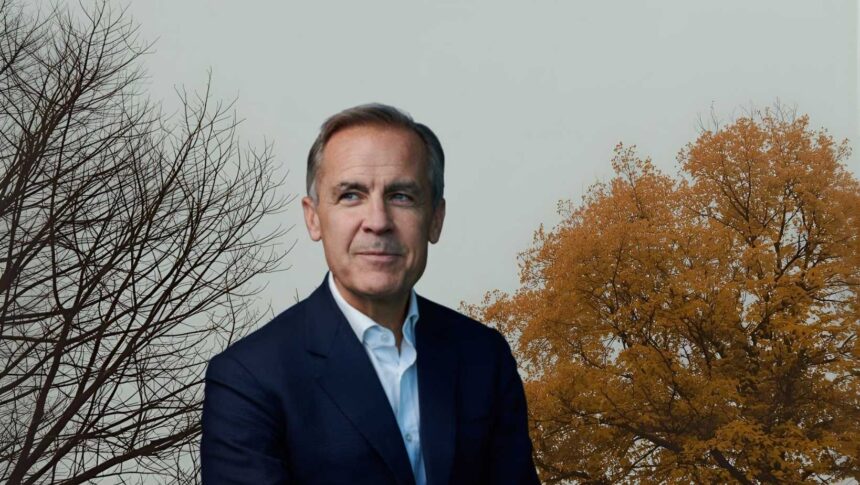

Mark Carney’s 2015 warning that climate change posed a “tragedy of the horizon” gave finance a common language for risk and a practical to-do list: disclose, compare, price.

That speech seeded the Task Force on Climate-related Financial Disclosures, whose voluntary template became the global shorthand for climate risk in annual reports and prospectuses.

It was the right idea for its moment, when Brexit politics and global fragmentation pushed regulators to let markets move first.

The architecture he championed has since been absorbed and upgraded.

The TCFD disbanded in 2023 after the Financial Stability Board asked the IFRS Foundation’s International Sustainability Standards Board to take over monitoring.

ISSB’s S1 and S2 standards now form the backbone for investor-grade sustainability reporting, effectively hard-wiring TCFD concepts into financial reporting.

Britain is preparing to localize those rules, the government is consulting on UK Sustainability Reporting Standards based on ISSB, with the consultation running through September 17, 2025.

The Financial Conduct Authority is already rolling out its Sustainability Disclosure Requirements, including an anti-greenwashing rule that took effect on May 31, 2024, with labeling, naming and marketing rules phasing in afterward.

Then came a setback that underscores why the old playbook needs a refresh.

After weighing costs and benefits, the Treasury decided in July that the UK will not proceed with a domestic green taxonomy, removing what was once billed as a cornerstone of the post-Brexit green-finance regime.

Without a taxonomy to define “green,” supervisors will have to rely even more on disclosures, labeling rules and enforcement to police claims.

From disclosure to delivery

Markets do not move on PDFs alone. ISSB has begun to bridge the gap with practical guidance on how companies should disclose climate transition plans under S2.

The guidance draws directly on the UK Transition Plan Taskforce’s work, which set out what credible plans look like. That is progress, but it still stops short of requiring companies or lenders to have a plan, let alone to meet one.

The case for stronger plumbing is twofold: First, capital is shifting, but unevenly. The International Energy Agency projects global energy investment of about 3.3 trillion dollars in 2025, with roughly two-thirds for clean energy.

That is a historic tilt, yet aggregate bank financing to fossil fuel companies remains sizable, according to NGO tallies. In short, disclosure is changing behavior, but not fast or predictably enough to align with economy-wide goals.

Second, politics has moved, IOSCO has endorsed ISSB to give regulators cover to act, and many jurisdictions are moving toward mandatory baselines.

By contrast, the United States’ SEC climate rule remains in limbo after a stay and the Commission’s decision to end its defense in court.

What would an upgrade look like now? Start by locking in transition-plan expectations where investors can enforce them.

The FCA can build on ISSB’s S2 guidance and the TPT framework to require listed companies to publish decision-useful plans or explain why they do not, with consistent metrics for interim targets, capex alignment and governance.

Banks and insurers should meet parallel expectations at the portfolio level, with clarity on financed emissions methodologies and use of offsets.

That would not mandate decarbonization outcomes, but it would require credible, comparable road maps that investors can test against cash flows and risk models.

Supervision will also have to lean into credibility checks. The anti-greenwashing rule gives the UK a practical tool to challenge exaggerated claims in marketing and disclosures.

Combined with SDR labels and product-level reporting, it can push capital toward strategies that match their names. If the taxonomy is off the table, accountability needs to live in the plan, the label and the audit trail.

Finally, coordination matters. GFANZ still counts hundreds of members and has helped normalize the idea that financial institutions must plan their own transition.

Voluntary coalitions cannot substitute for policy, but they can accelerate the adoption of good practice once supervisors set the baseline. The next phase is not about abandoning Carney’s approach, it is about finishing it.