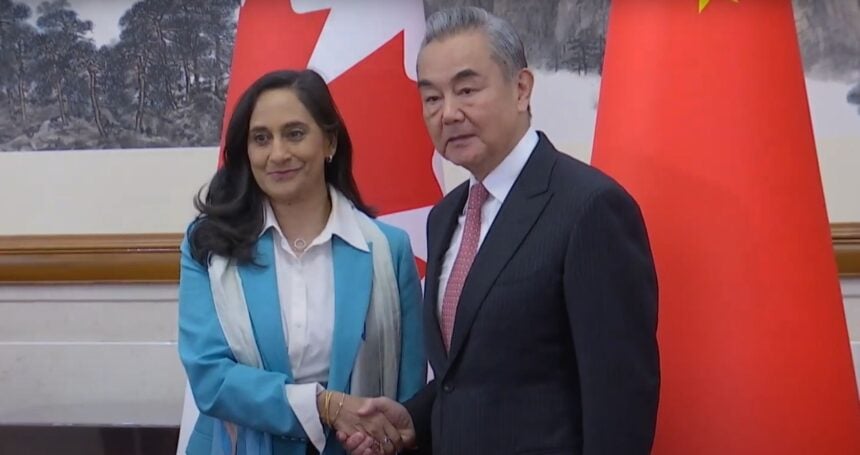

Canada is edging back into high level talks with China, sending Treasury Board President Anita Anand to meet Foreign Minister Wang Yi in a bid to stabilize a relationship that has chilled commerce and complicated foreign investment decisions.

It is a pragmatic attempt to reopen channels that matter to exporters, miners, universities, and airlines without relaxing the national security stance that Ottawa has tightened since 2018.

The meeting lands in a moment when Canada is trying to diversify in the Indo-Pacific yet still relies on China for a slice of demand across agriculture, energy, and metals.

China remains a major buyer of potash and canola and a swing consumer for copper and nickel. Any measured improvement in official ties could ease frictions on inspections, standards, visas, and flights that raise costs for Canadian firms.

A misstep would do the opposite, inviting fresh uncertainty at a time when financing is already dear and equity markets are sensitive to geopolitical surprises.

Critical minerals sit at the center of the economic case for a careful thaw. Ottawa has screened state linked investment more aggressively in recent years, including ordering exits from Canadian juniors with strategic assets.

This policy is unlikely to change, but clearer lines of communication can still help producers plan capital spending and offtake agreements.

Demand for grid upgrades, data centers, and electric vehicles is rising, and Canada is debating where new supply will come from.

Our earlier reporting on what Ottawa sees in copper provides the backdrop for how trade diplomacy intersects with investment and permitting dynamics. See our analysis of what Ottawa sees in copper and how industry consolidation, including the Teck and Anglo merger, has reshaped expectations.

Chinese students once formed a large cohort at Canadian universities, supporting local economies and research budgets. The pipeline shrank as relations deteriorated and travel lagged.

More flights and faster visa processing would help campuses and carriers rebuild, though both sides would need to agree on guardrails that address interference concerns.

Agriculture has been whipsawed by politics before, from sudden import restrictions to prolonged inspections. A more functional ministerial dialogue would not eliminate those risks, but it could shorten the shelf life of disputes.

Producers and shippers in the Prairies watch these channels closely because they determine when a crop can move and at what price.

Provincial exporters have also dealt with domestic cost pressures as they navigated broader tariff and logistics challenges. Ottawa’s tariff relief program last year underscored how policy can cushion local fallout when global frictions flare.

Security agencies have warned about interference, and Parliament has grappled with how to manage that risk. The government has emphasized that cooperation on trade and climate will proceed only alongside clearer protections for critical infrastructure, research, and diaspora communities.

Beijing, for its part, has pressed for fewer restrictions on investment and technology access. It can, however, be managed well enough to keep commerce predictable.

Canada’s bet on a limited reset will be judged by results that move through ports, classrooms, and mine sites long before they are reflected in diplomatic communiqués.